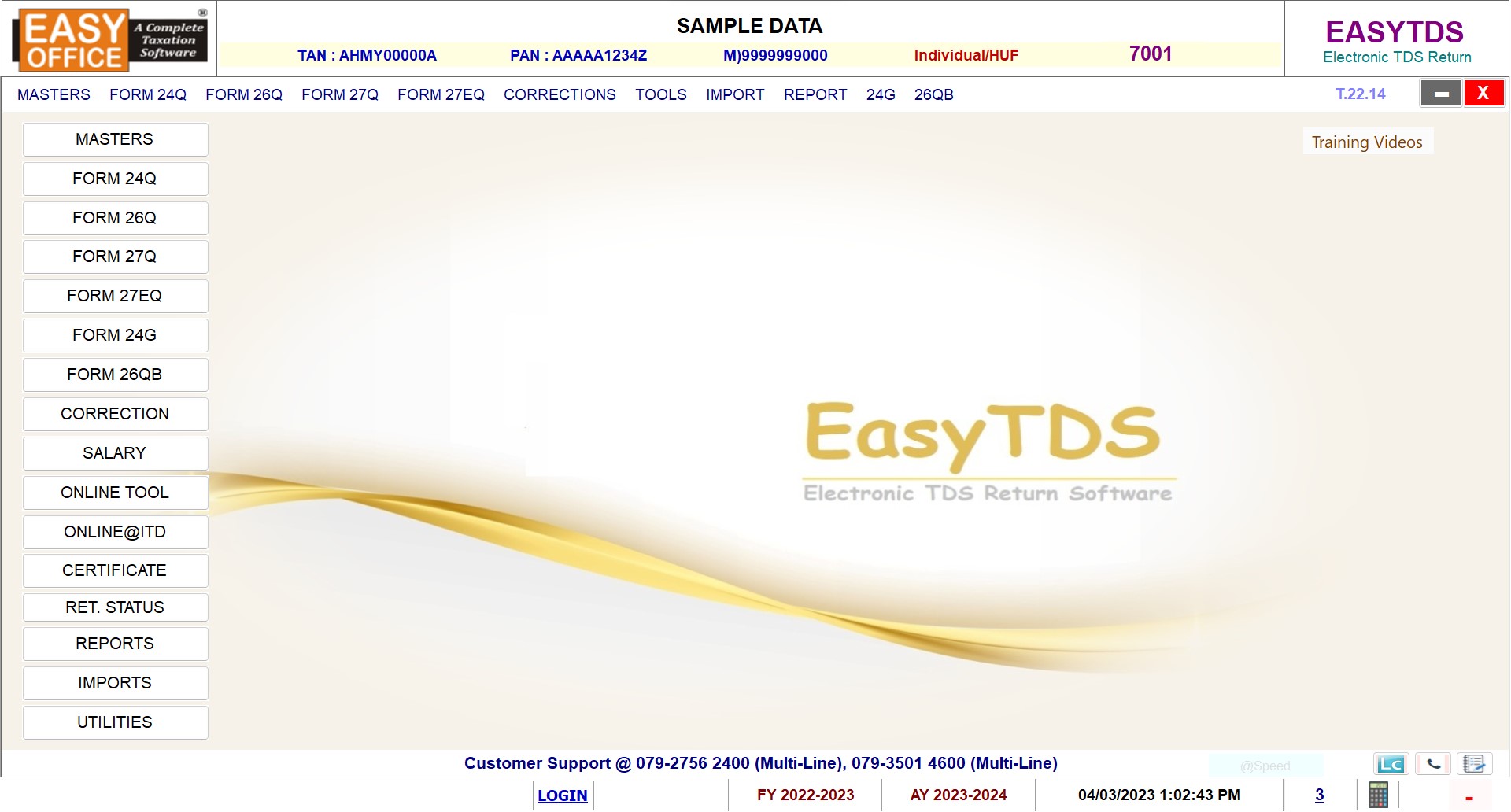

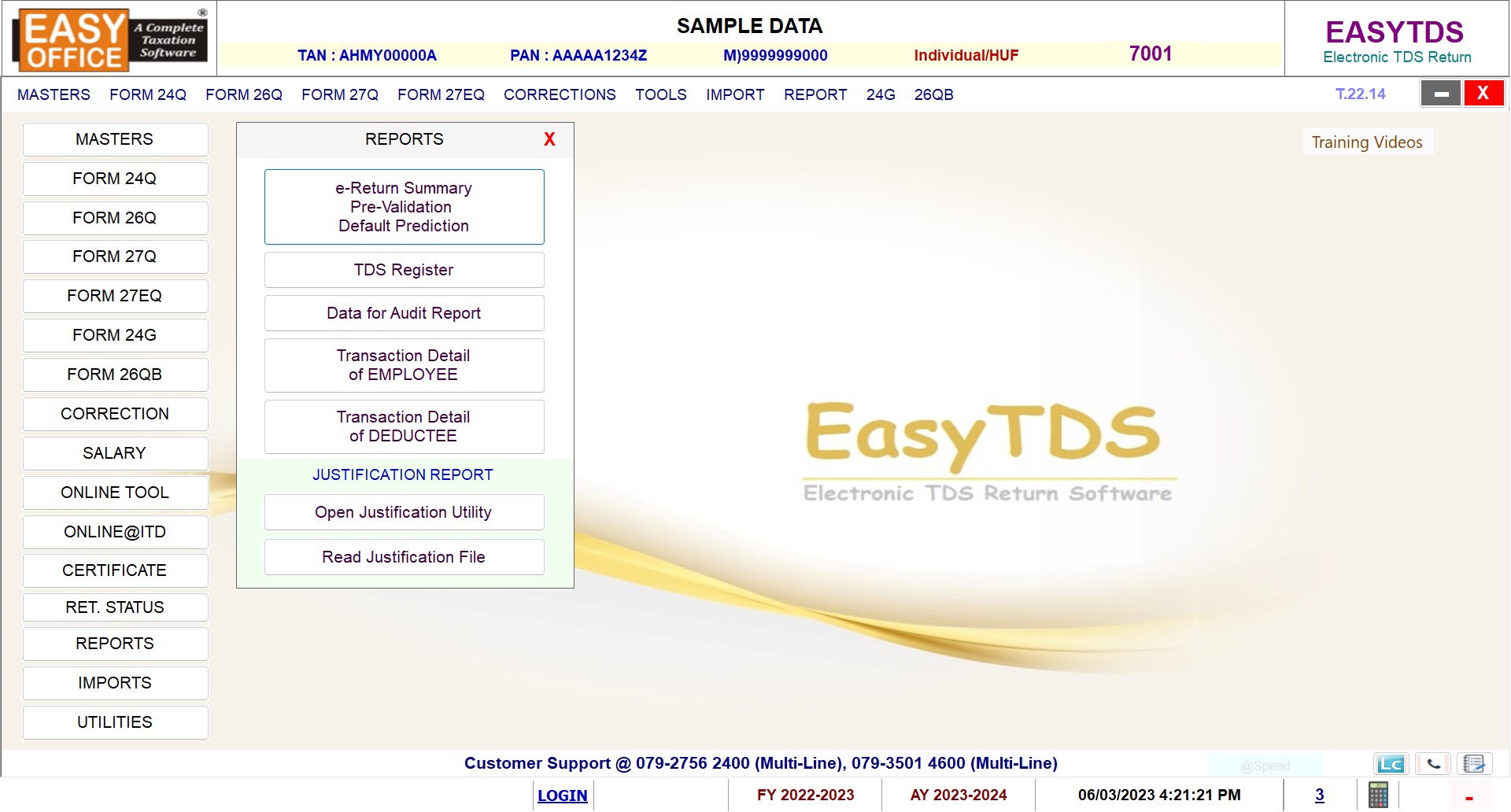

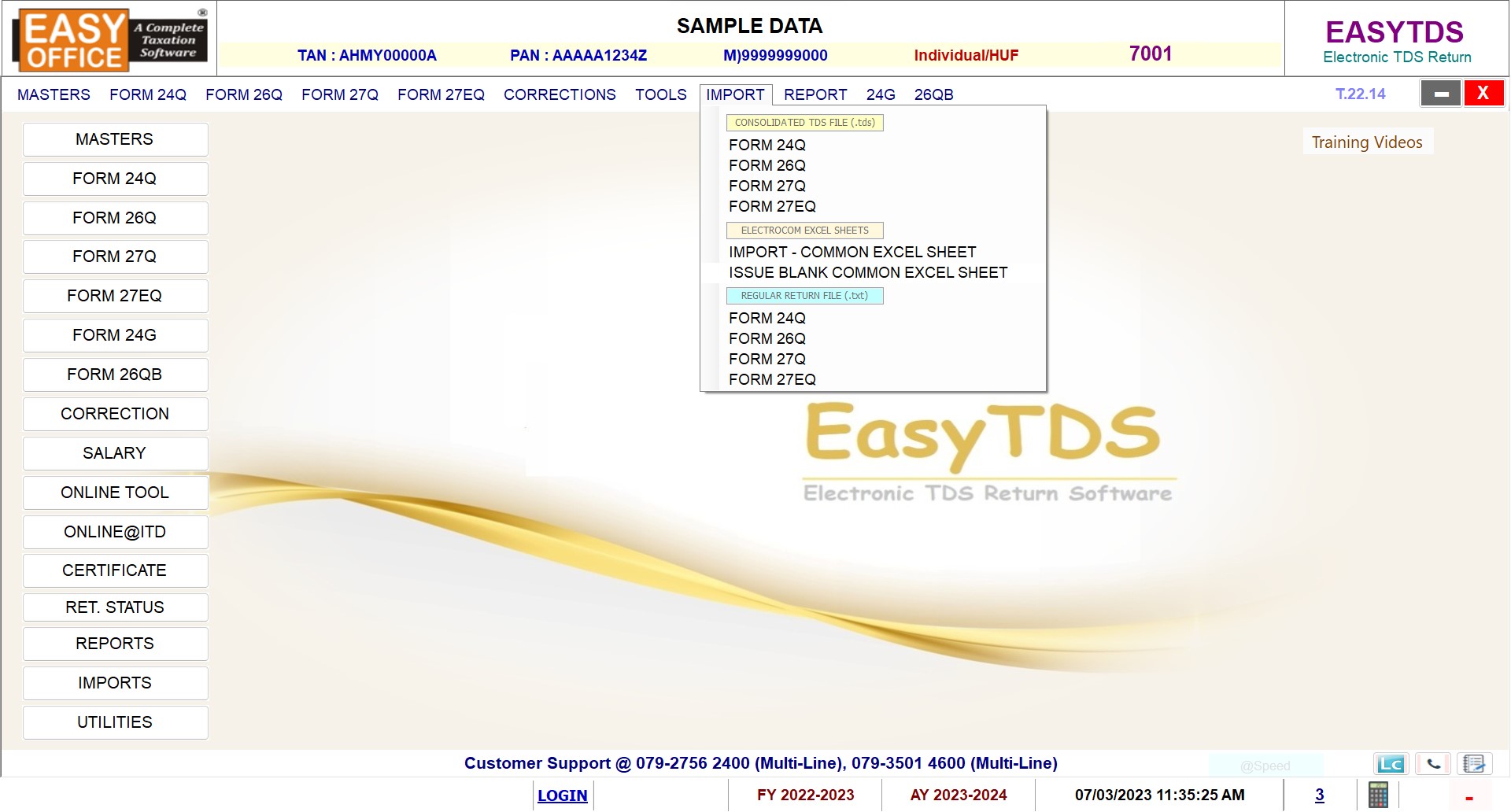

E-filing

of Return

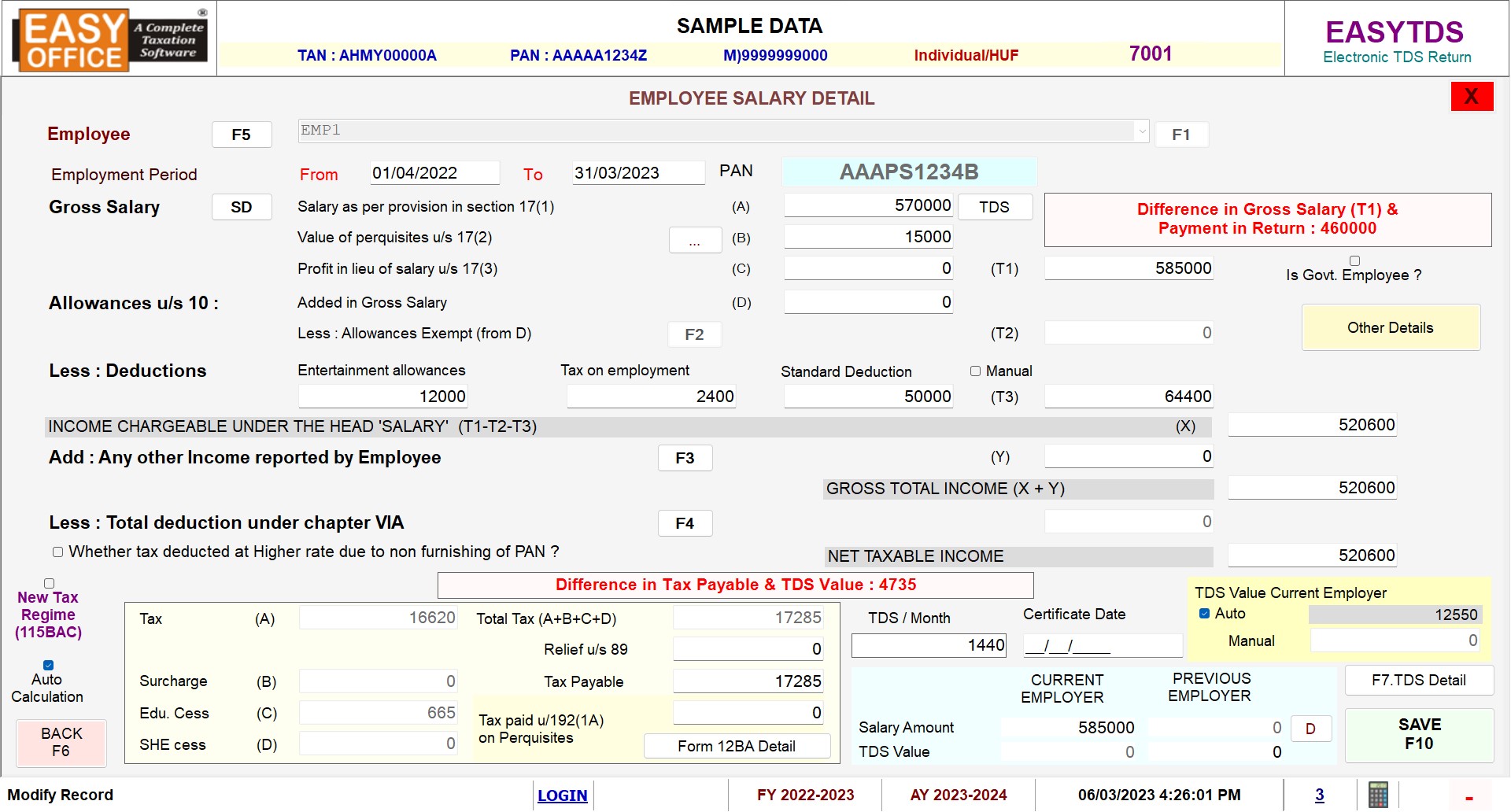

24Q

26Q

27Q

27EQ

24G

26QB

24Q

26Q

27Q

27EQ

24G

26QB

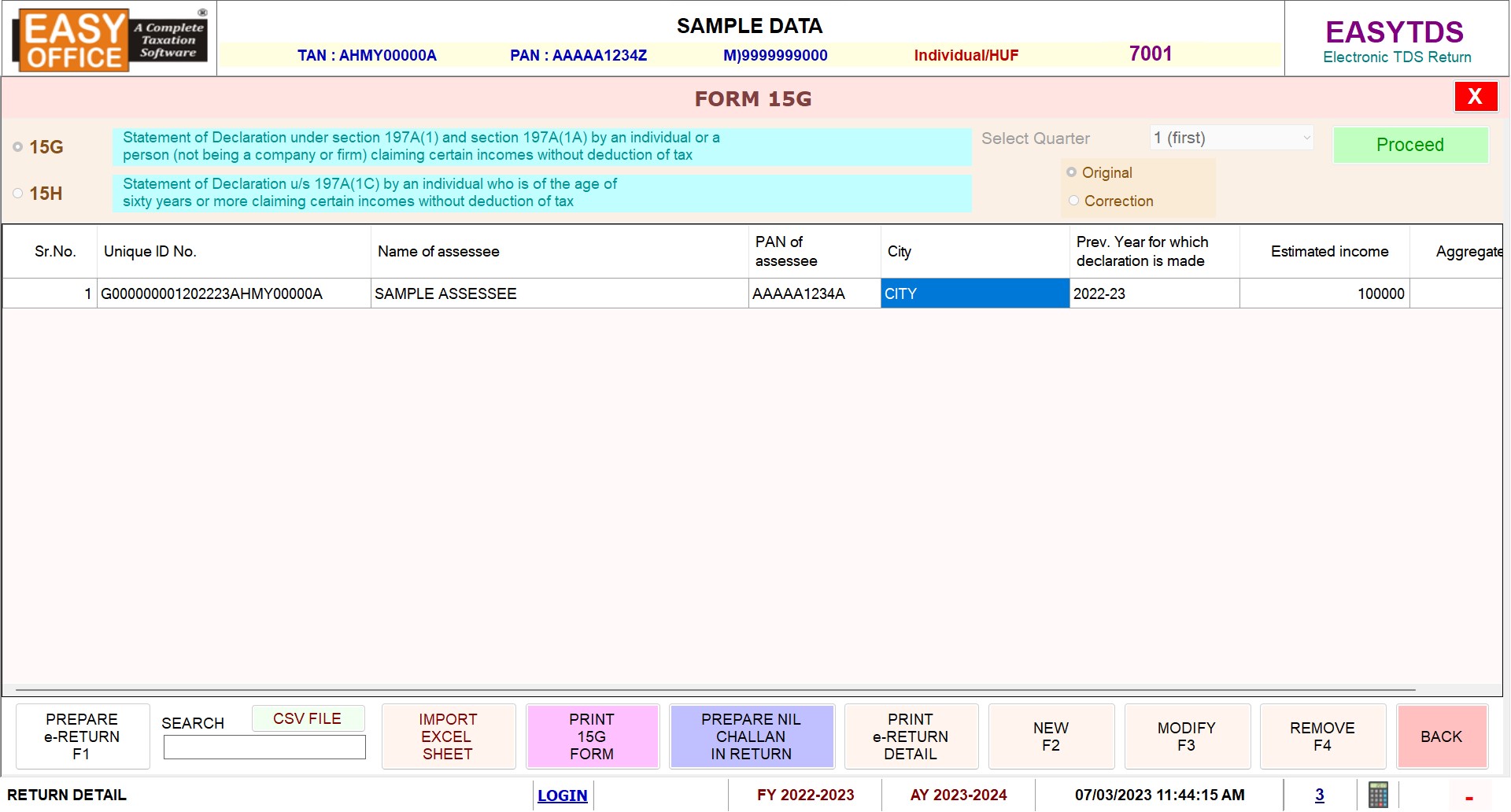

PAN verification with name Extraction

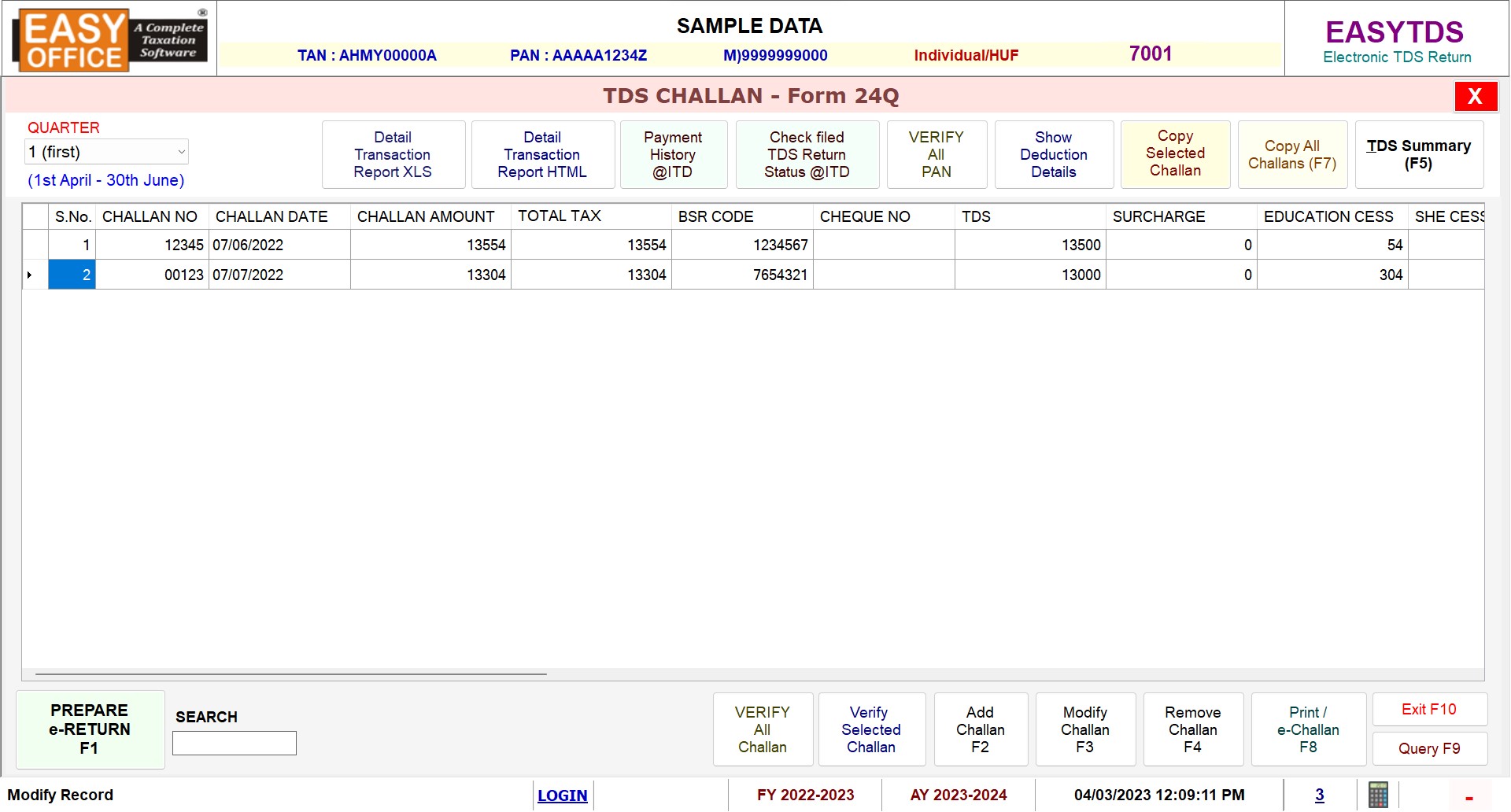

Challan details & verifications

Short Deductions

Lower Deductions

Late payment & Interest calculation

Late Fee Calculation

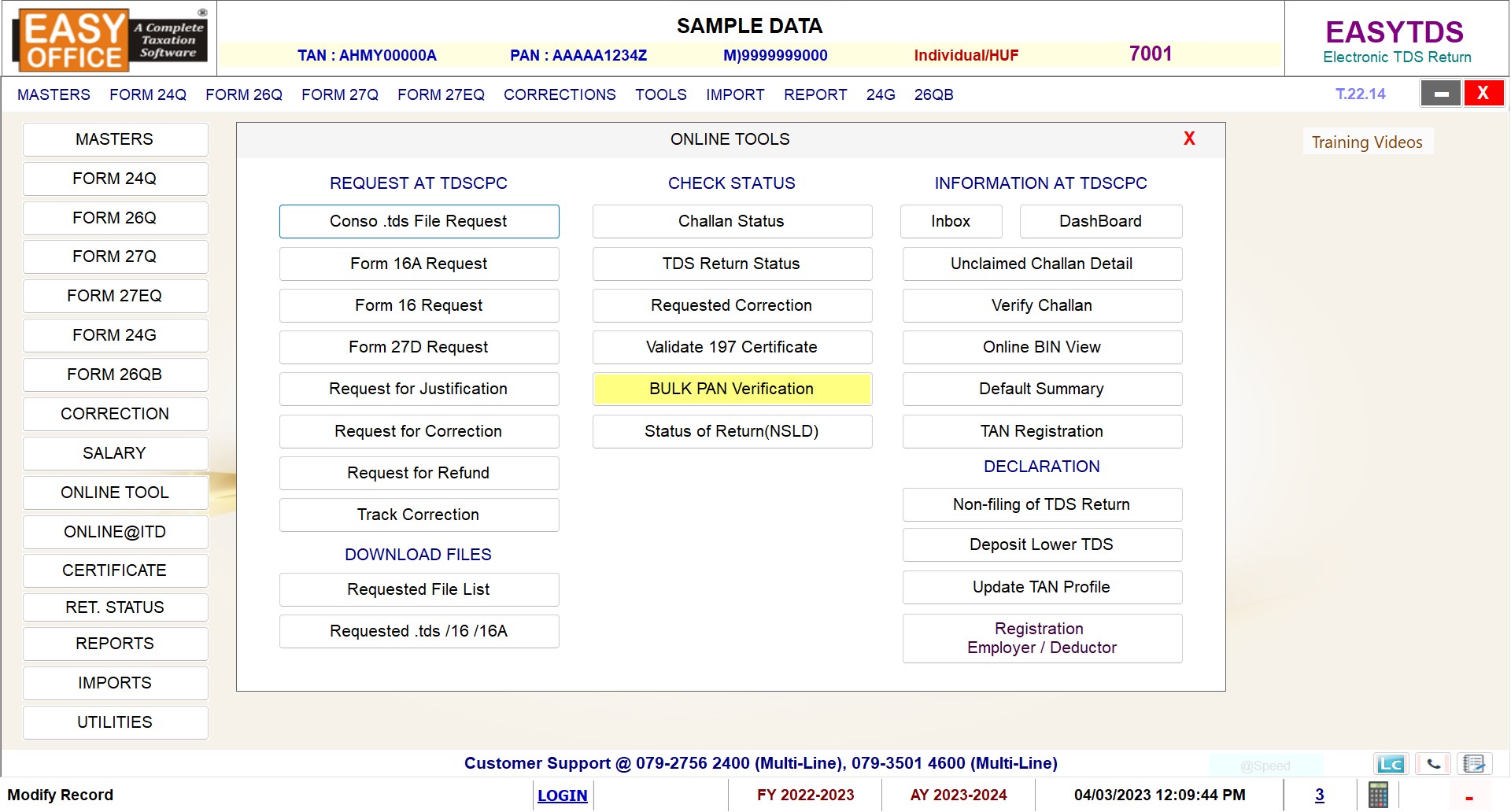

Fully Integrated with TRACES & Income Tax Efiling portal

Automated TRACES Requests (Conso File, Justification Report, Certificates etc.)

Download Requested Files (Conso File, Certificates, Justification Report etc.)

Validation of Lower Deduction Certificate

View of Return filed status, Challan status etc.

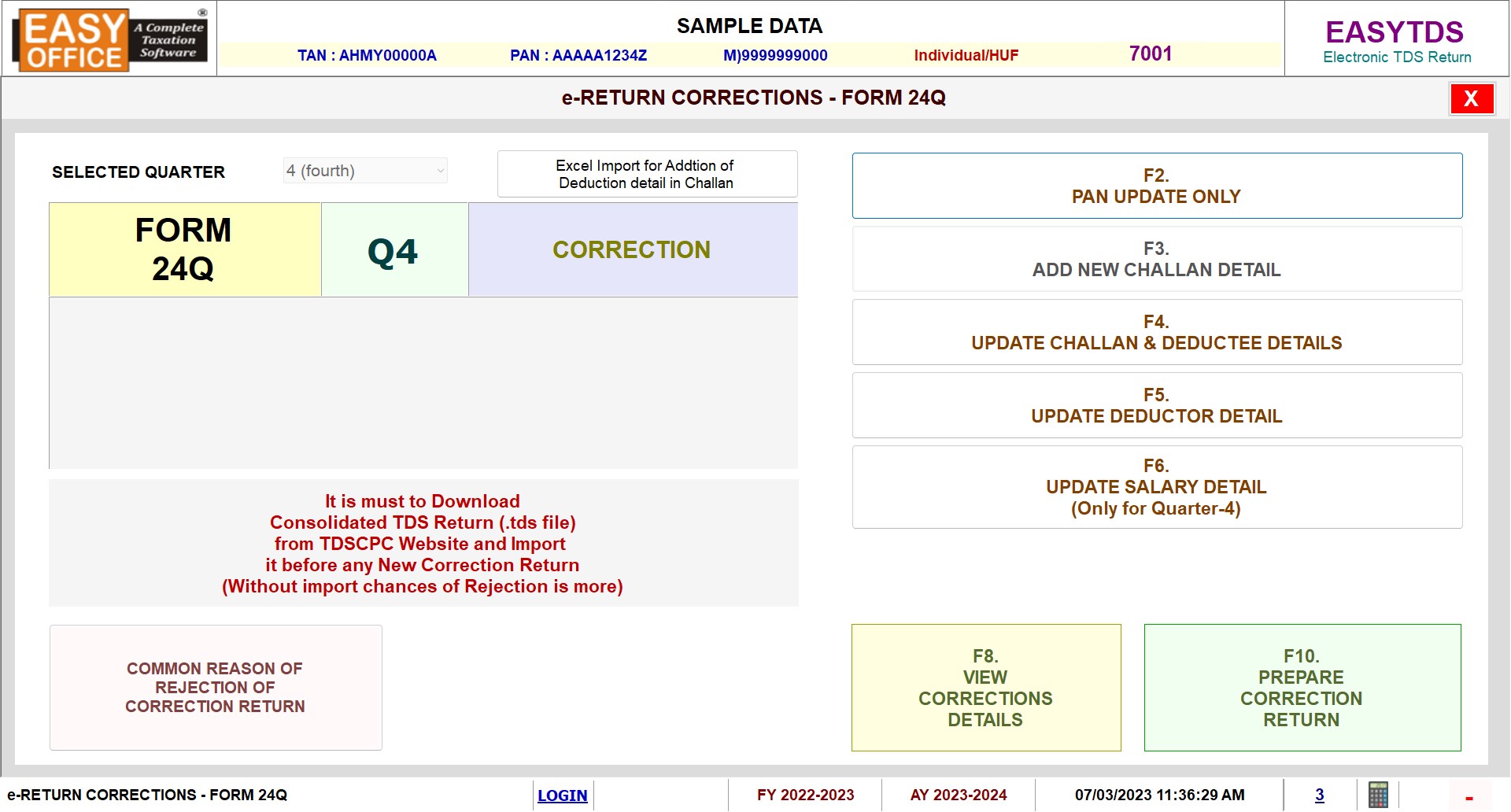

Revised Return through Correction module

Direct access to the TAN registration page

Download consolidated .TDS file for revised returns