Reports on Online available data

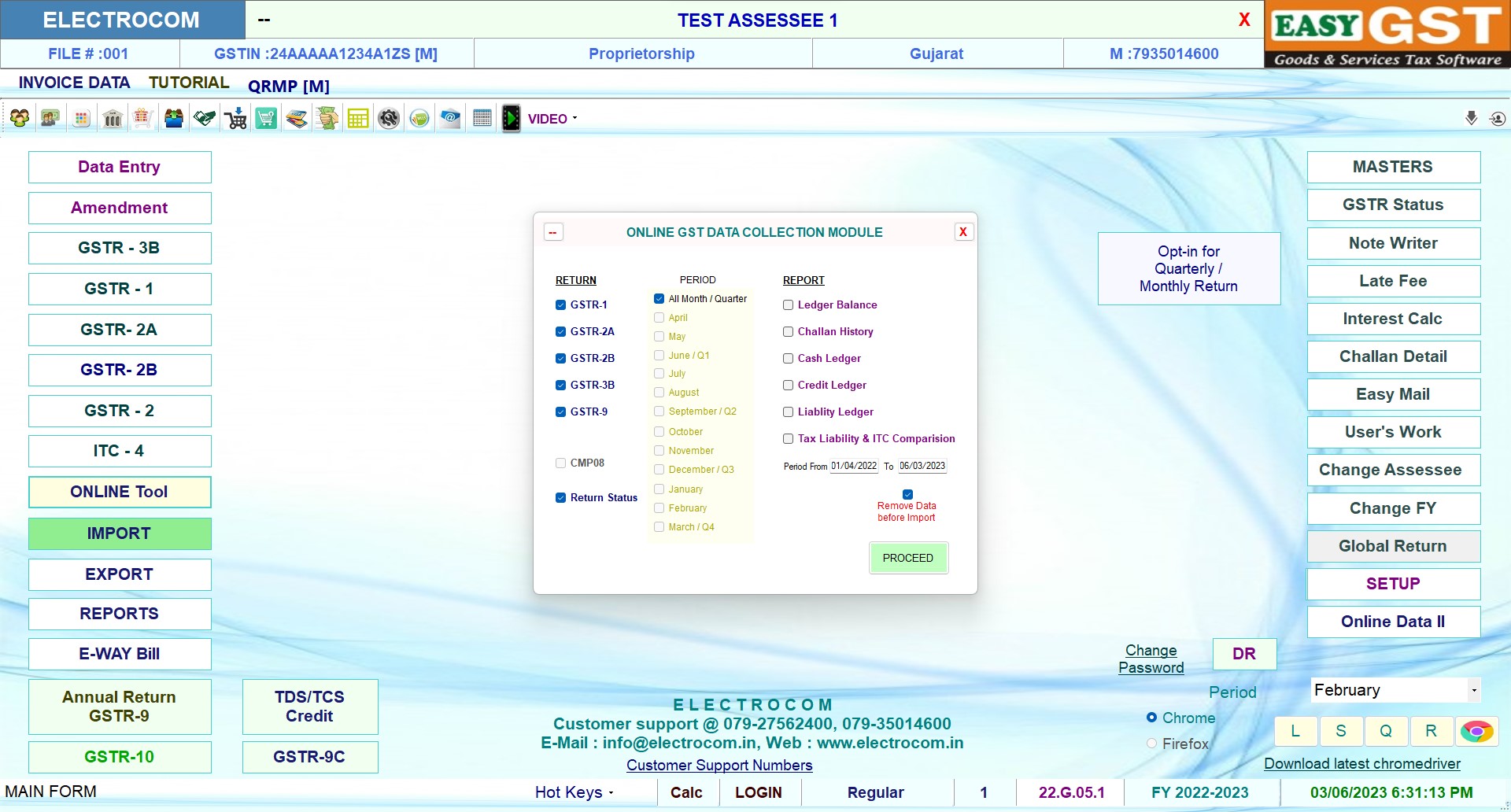

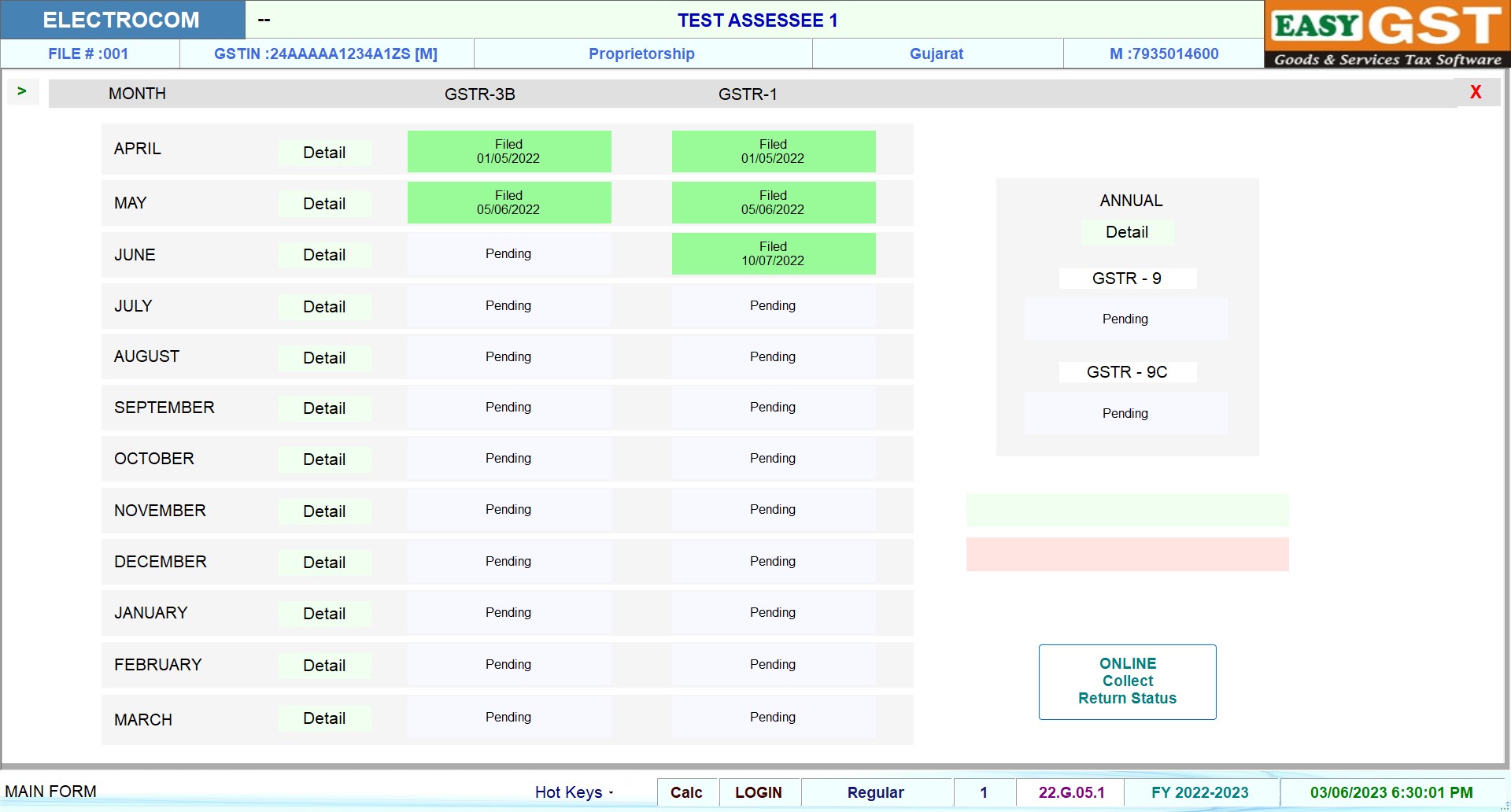

Return Status

Cash & ITC balance

Challan history

Cash/ Credit/ Liability Ledger

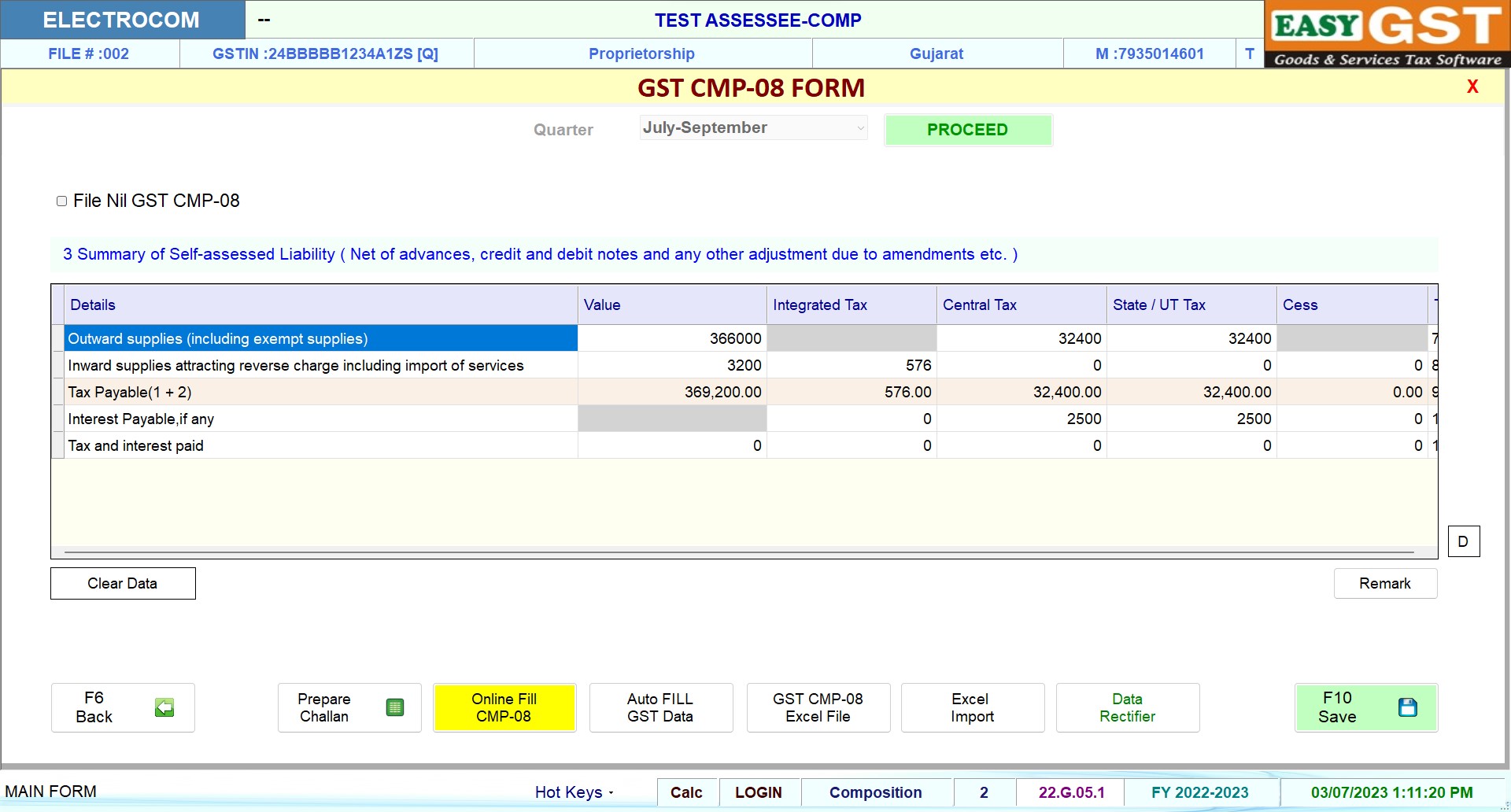

Tax liability & ITC Comparison

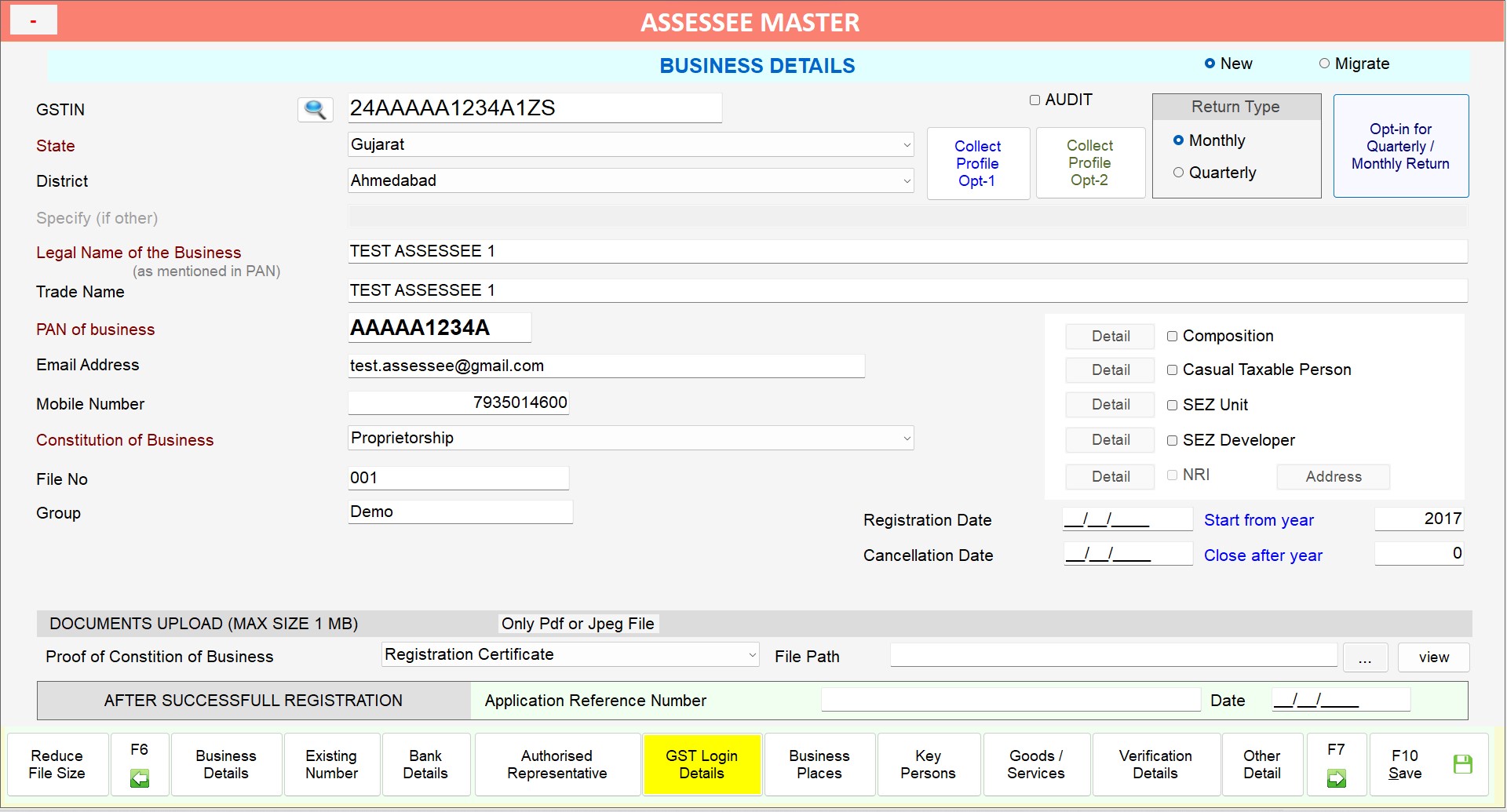

Data collection from the department

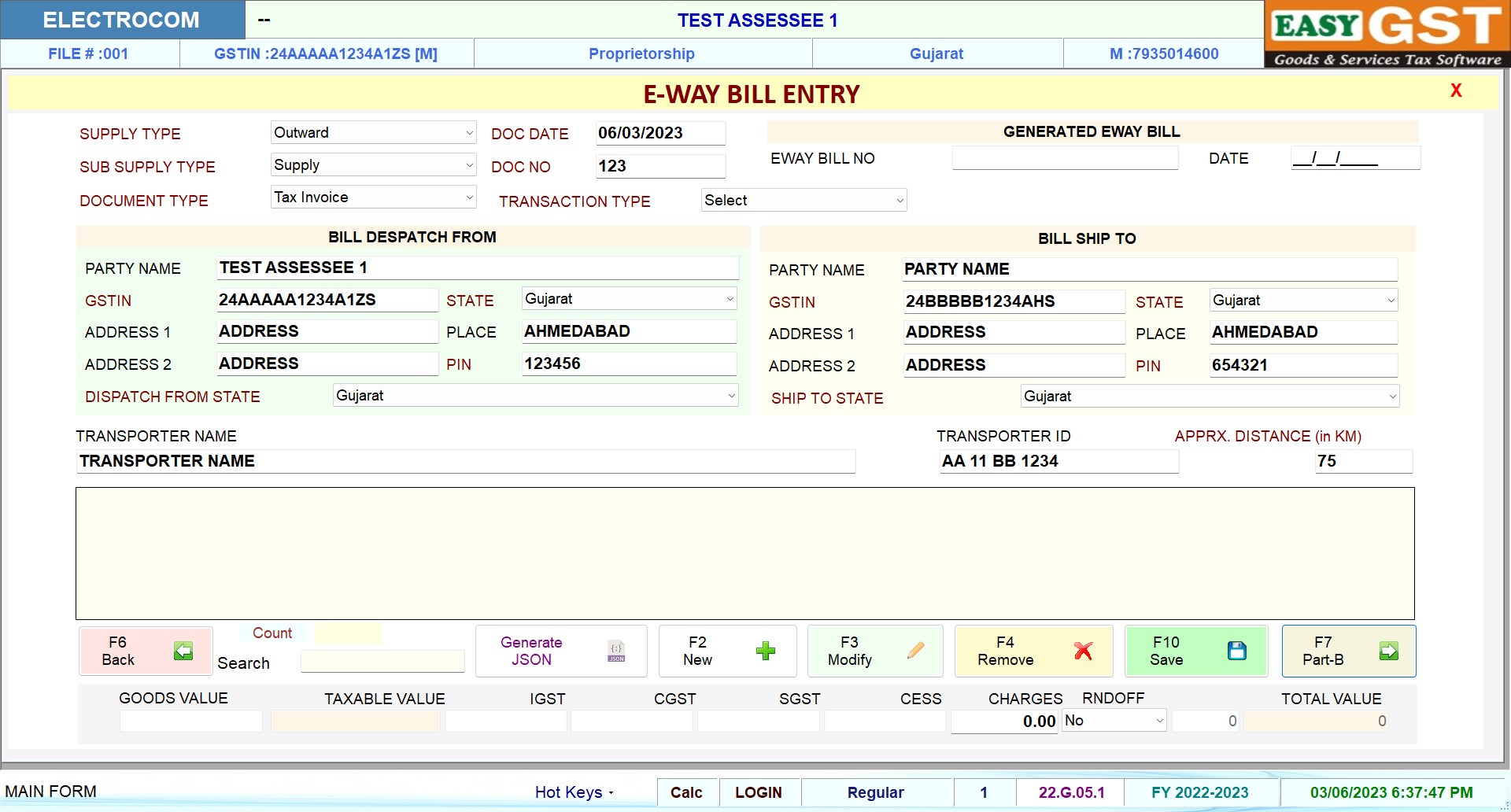

Import Data Through Excel Sheets/ JSON

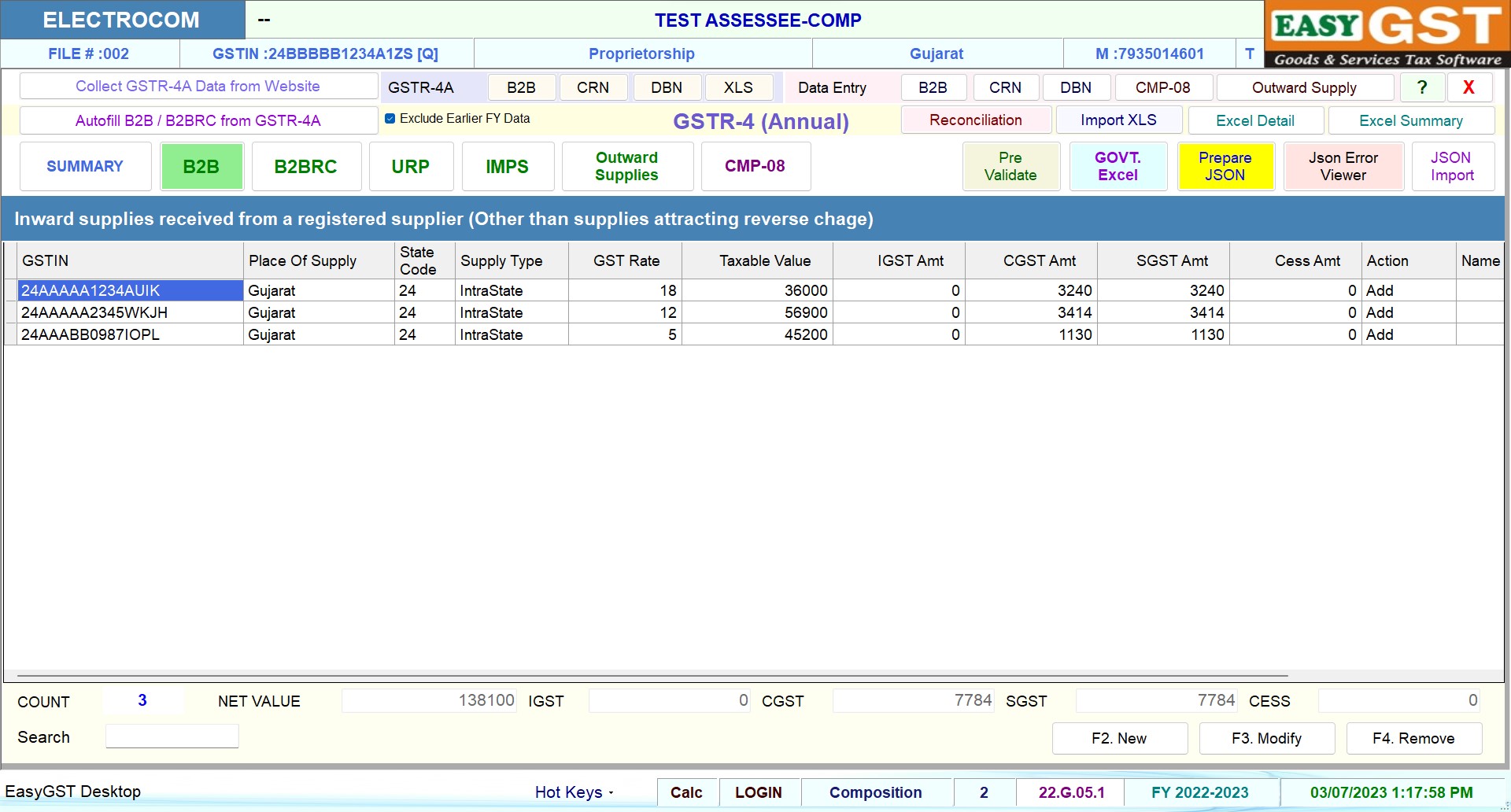

Manual Data Entry in Software

Reconcile the data

Pre-validation facility with multiple validations for identifying errors

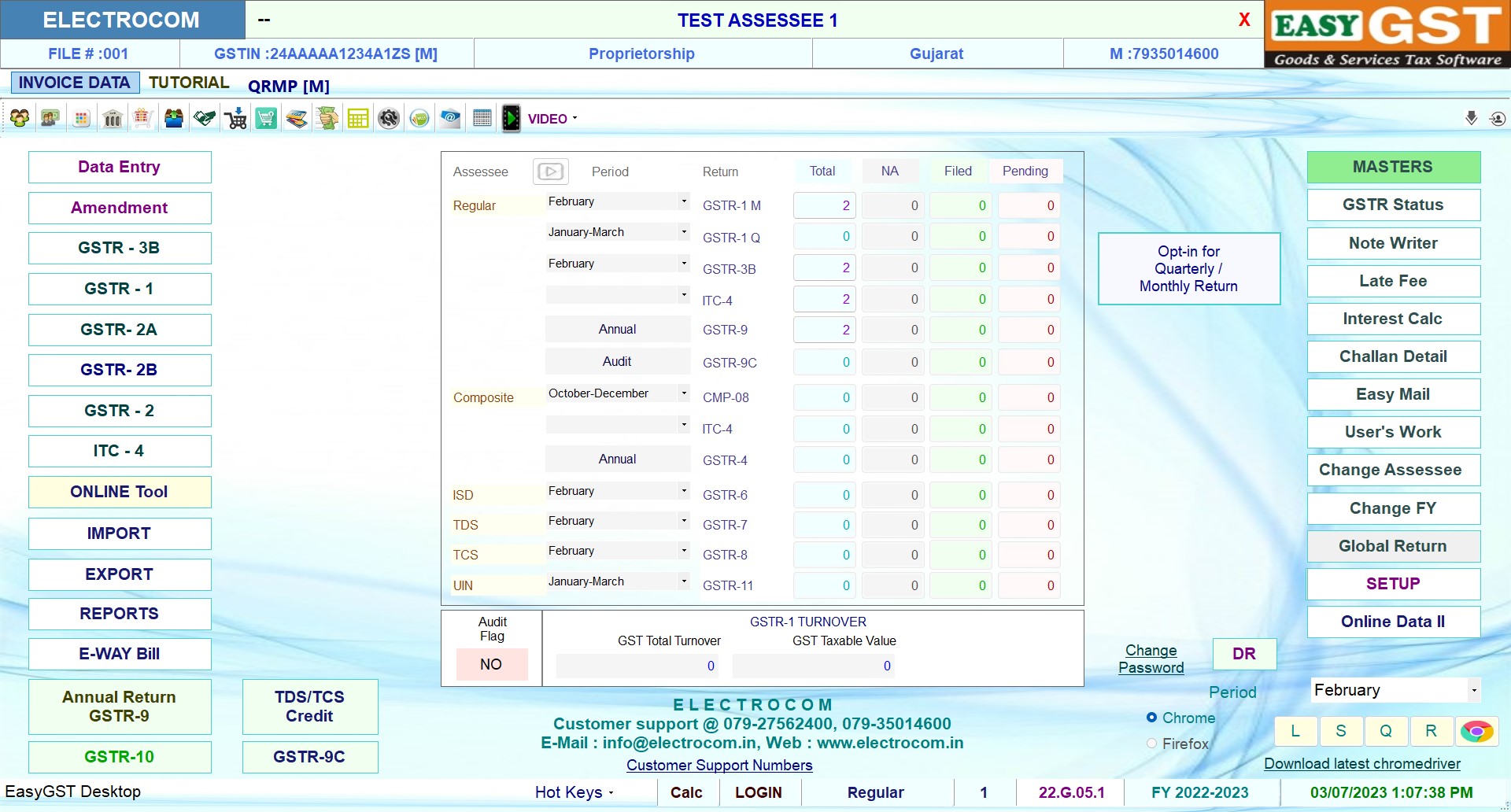

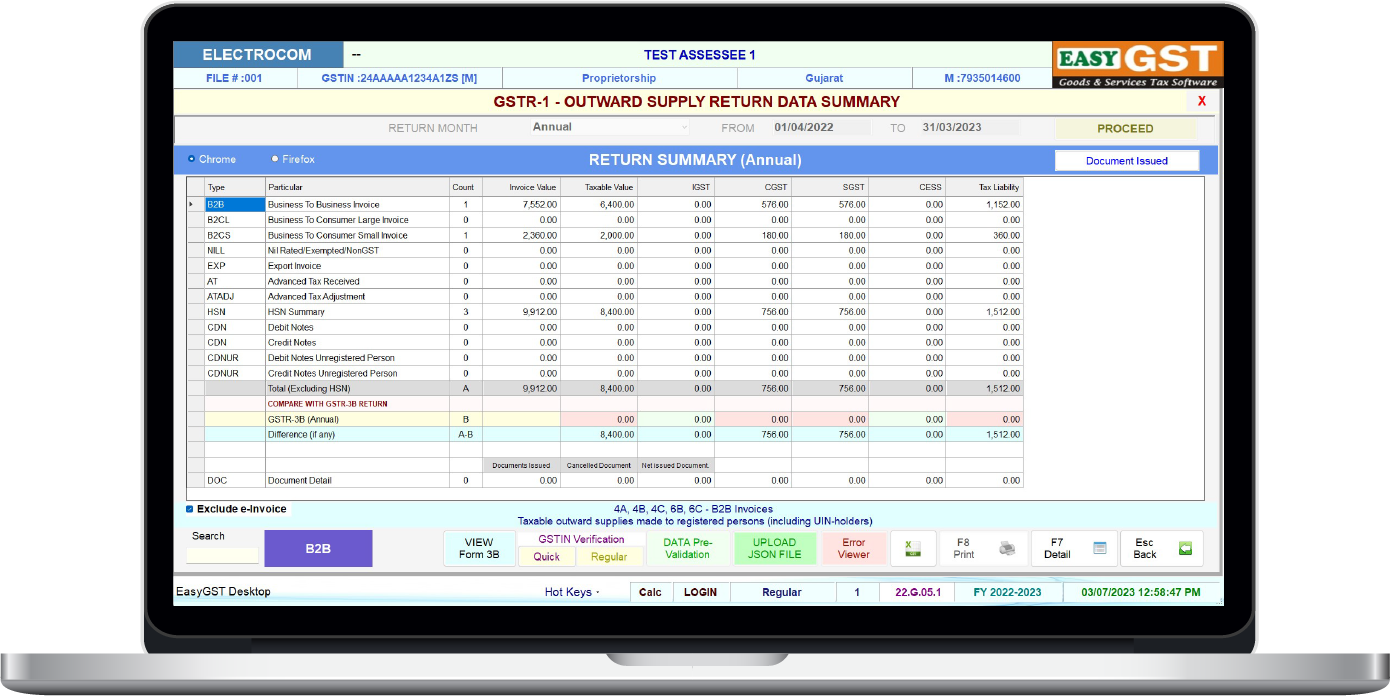

Return Summary view

Upload validated JSON file

Import and view error JSON

Submit the return and collect return status with ARN

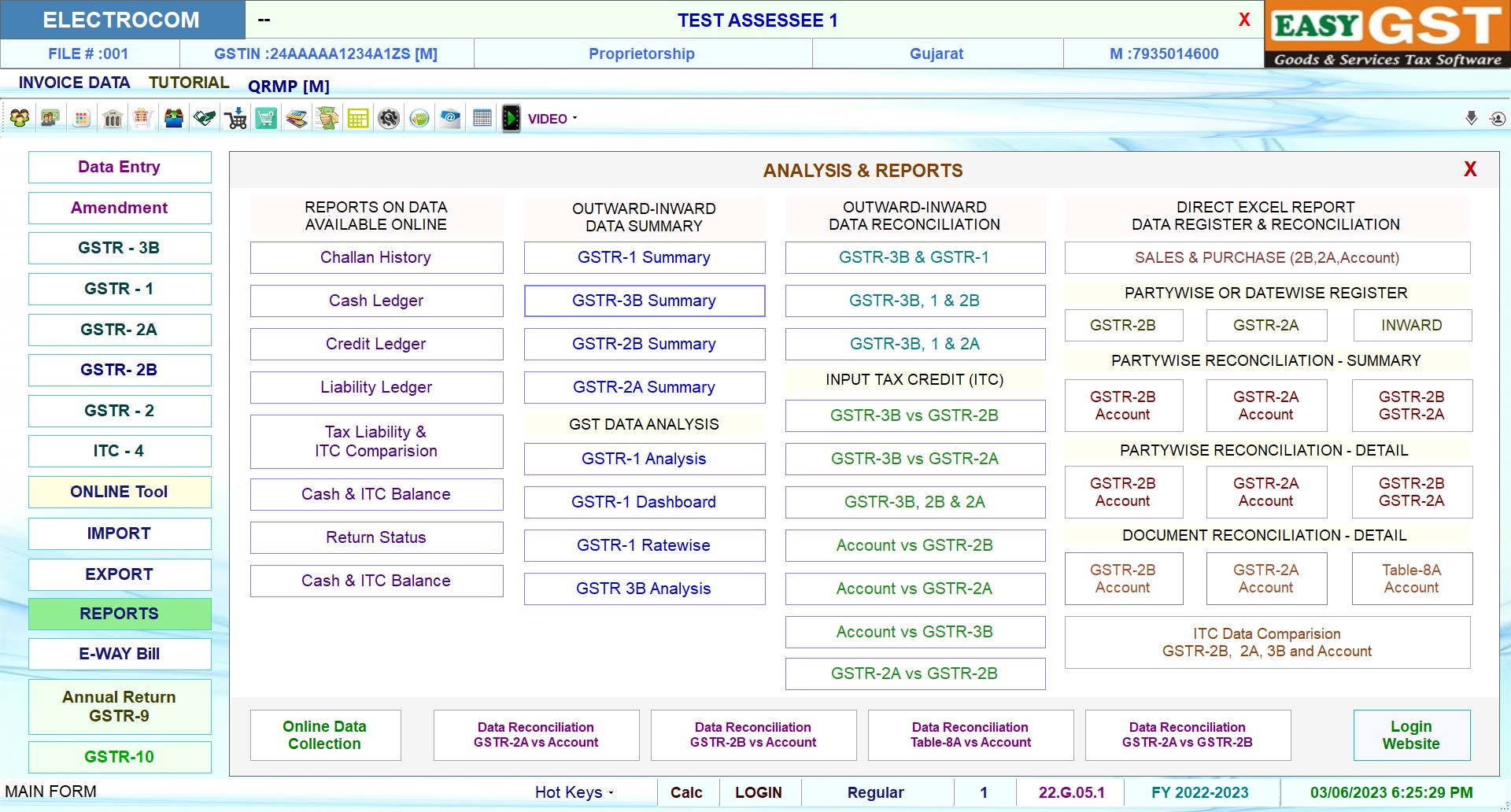

Reports on Online available data

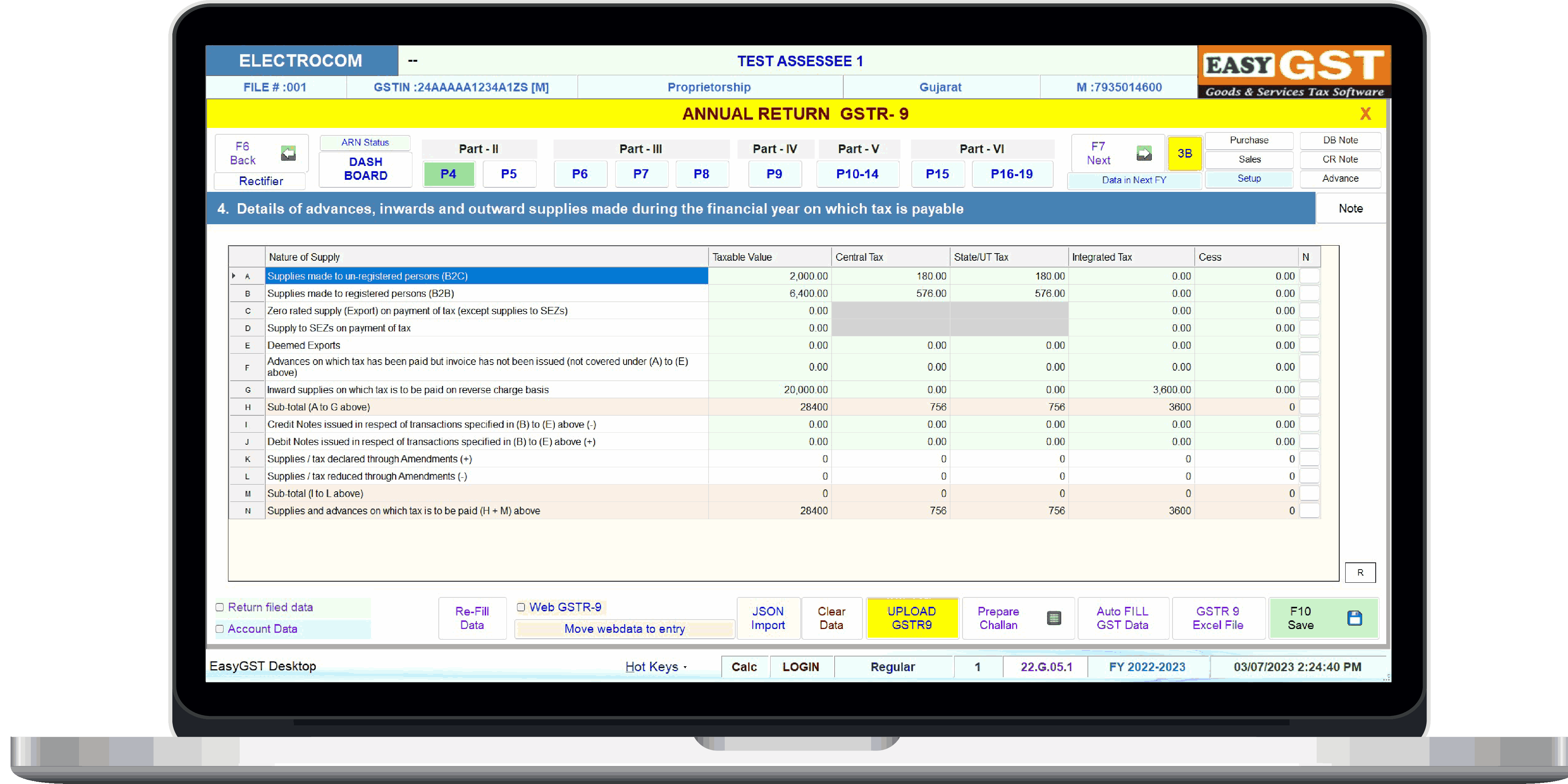

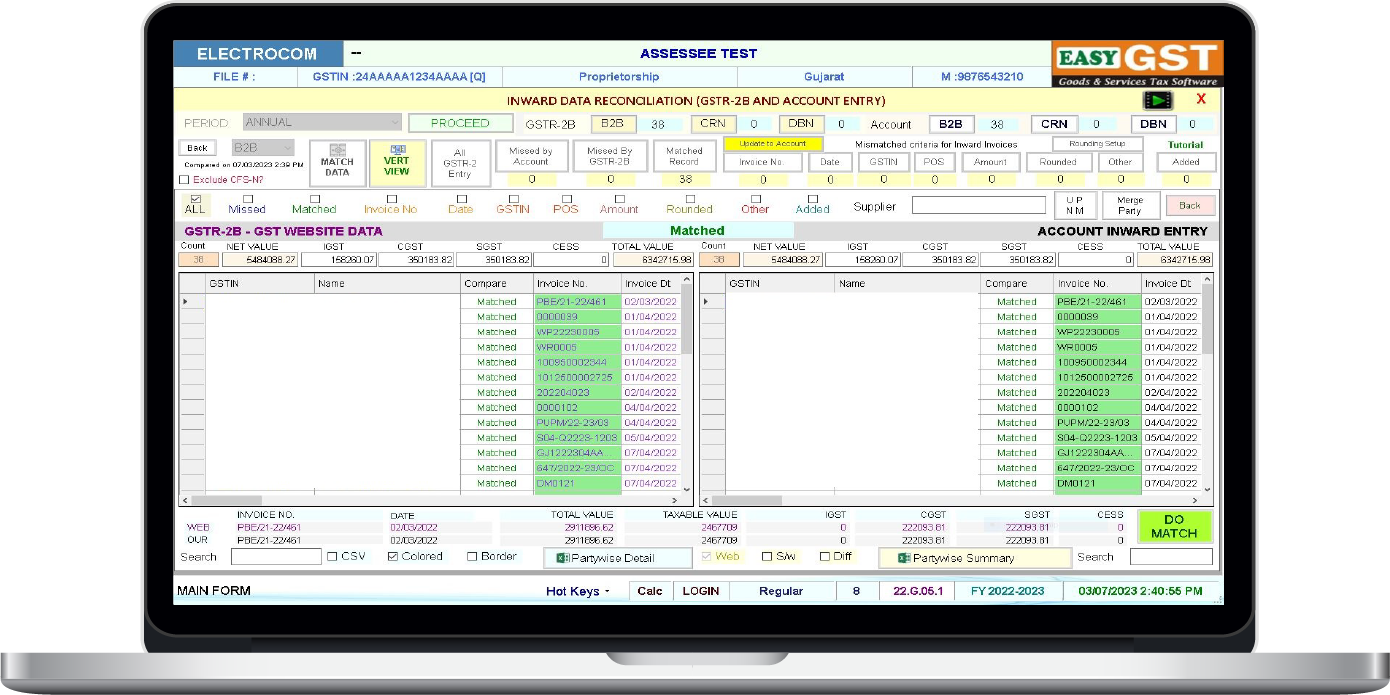

Outward-Inward data summary & Reconciliation

Input Tax Credit (ITC) Reports

Return Status

Cash & ITC balance

Challan history

Cash/ Credit/ Liability Ledger

Tax liability & ITC Comparison

GSTR 1 Summary and Analysis

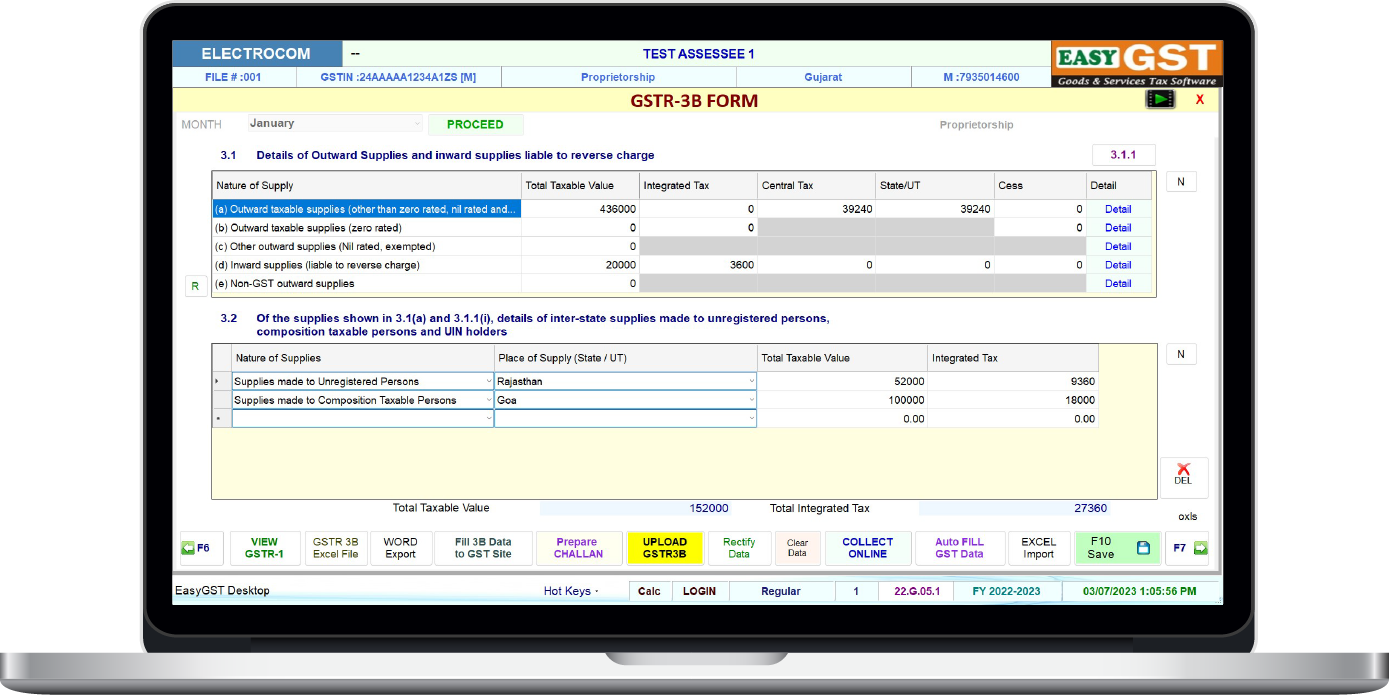

GSTR 3B Summary and Analysis

GSTR 2B/2A Summary

GSTR 3B with GSTR 2B/2A

GSTR 2B/2A/3B with Accounts data

GSTR 2A with GSTR 2B

GSTR 3B with GSTR 1

GSTR 3B, GSTR 1 & GSTR 2B/2A

GSTR 2B/2A with Accounts

GSTR 2B with GSTR 2A